What we do

Investing

personalised Investment Advice

At Baggot, we understand that your financial goals are as unique as you are. That’s why we offer personalized investment strategies tailored to your individual needs.

Recognizing that each individual’s approach to risk is different, we carefully evaluate your willingness and capacity to bear risk, ensuring that your investment portfolio is a true reflection of your financial identity.

We provide you with tailored recommendations based on your individual financial goals, risk tolerance, time horizon, and other personal factors.

We actively manage and monitor your investments, conducting regular reviews and rebalancing to ensure that your portfolio remains in line with your evolving goals and the changing market.

Our strategies are designed to be as tax-efficient as possible, ensuring that more of your earnings are working towards your financial goals.

PORTFOLIO

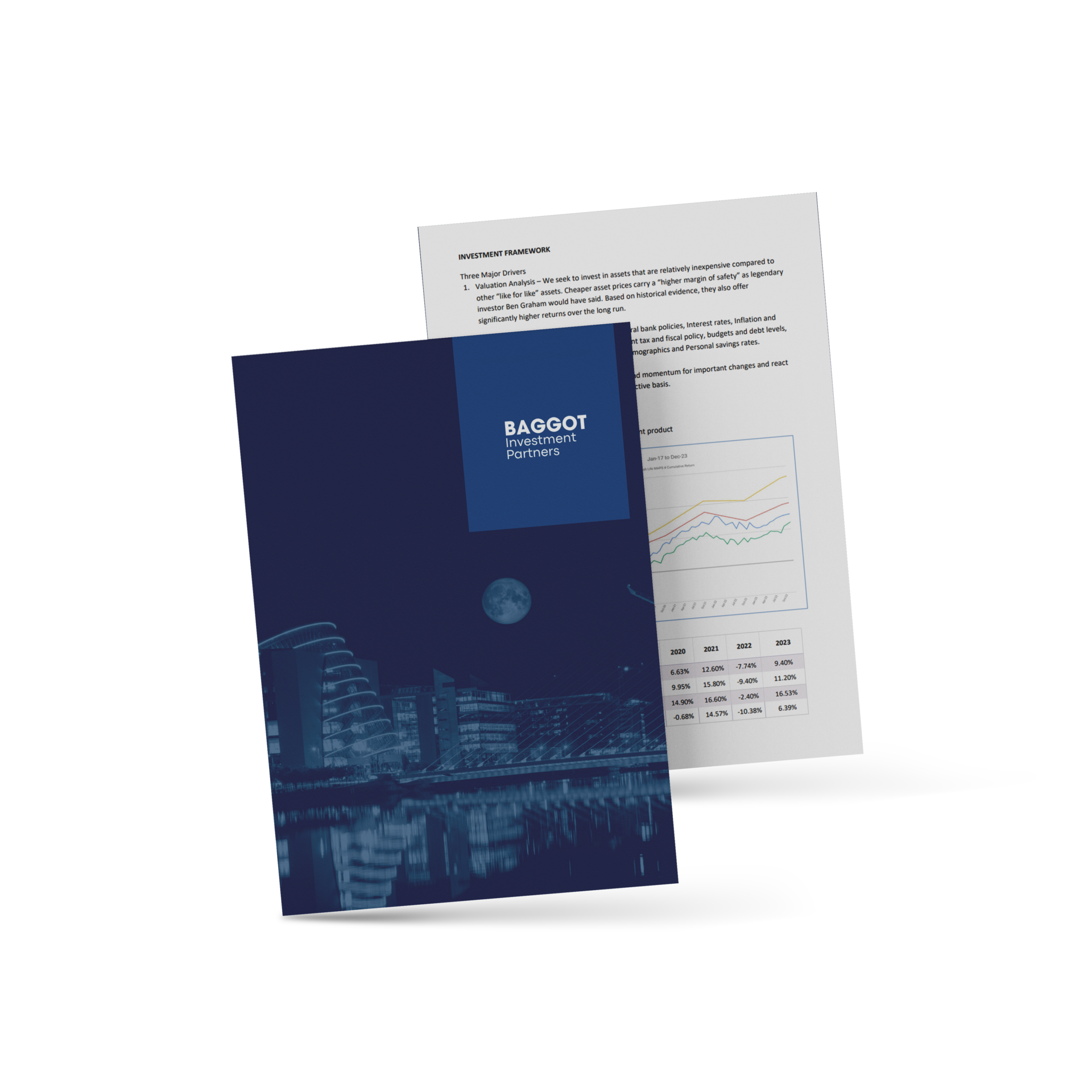

Baggot Multi Asset Portfolio (BMA)

Baggot Multi-Asset Portfolio (BMA) is a Diversified strategy which aims to provide positive annualised investment returns on a medium to long term basis, while managing the portfolio within its risk parameters.

This investment strategy can invest in a range of asset classes such as Bonds, Equities, Property (REITs), Commodities and Cash. BMA is available in various risk formats which makes it suitable for our cautious, medium, and high-risk clients. We monitor our portfolios daily and make changes to our asset mix when required, in line with our Investment Framework.

PORTFOLIO

Baggot Equity Income Portfolio (BEI)

Baggot Equity Income Portfolio (BEI) contains holdings of ETFs , investment trusts and individual equities. The portfolio is a basket of global equities focused on income via dividends and capital growth. All assets held are subject to CGT tax rates on gains and standard tax rates on dividends.

By incorporating Equity ETFs and Investment Trusts into our process we are able to add broad diversification to the portfolio without high transaction costs. Further, Investment Trusts can trade at a discount or premium to Net Asset Value (NAV) depending on the market environment. Subsequently, our manager looks to take advantage of periods in time when well managed Investment Trusts trade at significant discounts to NAV.

Experience the Baggot Difference.

Tailored Investments

We understand that every investor is unique, with distinct financial goals and risk tolerances.

We offer personalized investment strategies that are tailored to match individual needs, ensuring that each client's portfolio is aligned with their long-term objectives, life stage, and investment horizon.

Decades Of Experience

Our team at Baggot is well-equipped to navigate the complexities of the financial markets.

We combine many decades of experience with major financial institutions and pass that experience onto our clients.

Competitive Returns (ROI)

We provide a variety of investment portfolio options that have historically demonstrated strong returns on investment.

We utilize our extensive market knowledge to identify opportunities that aim to maximize gains and capitalize on market trends.

Unique Risk Assessment

Understanding and managing risk is at the core of Baggot's investment philosophy.

Our rigorous risk assessment procedures ensure that every investment decision is made with a clear understanding of the potential downsides, aiming to protect clients' capital and achieve stable growth.

Active Management

The financial markets are dynamic, and Baggot's proactive management approach means that we are constantly monitoring economic conditions and adjusting investment strategies as necessary.

This active stance allows us to effectively respond to market changes and opportunities, potentially imrpoving our overall portfolio performance.

Exceptional Service

At Baggot Investment Partners, client satisfaction is our main focus. We dedicate ourselves to providing exceptional financial services, ensuring a smooth and stress-free investment experience.

Experience the Baggot Difference yourself. Let's talk about your financial future.

Investing FAQ

How much money do I have to invest?

At Baggot Investment Partners, we cater to retail and corporate clients prepared to allocate a minimum of €100,000 for their investment portfolio.

Who can invest with Baggot?

We welcome both retail and corporate clients who have an investment allocation budget of €100,000 or more. Our services are tailored to meet the needs of high net-worth individuals and entities seeking sophisticated investment strategies.

What are your fees?

Our fee structure is tailored to the specific services and investment strategies we provide. Since these can vary based on individual client needs and portfolio complexities, we communicate in writing all our fees to clients prior to any investment.

What options do you offer?

We offer a broad spectrum of investment opportunities, including but not limited to customized portfolios, pension planning and tax-optimized solutions. Our focus is on providing diverse and strategic investment options that align with our clients’ unique financial goals. Unlike many brokers who offer off the shelf solutions, we are truly global in our search for quality assets to include in our portfolios.

Are investments risky?

Investment always carries some level of risk; however, the degree of risk varies across different types of investments. At Baggot, we prioritize understanding your risk tolerance and financial objectives to tailor a portfolio that balances potential risks with desired outcomes. Our expertise lies in navigating these risks to optimize your investment’s potential.

Still have questions?

If you would like to explore the various pension opportunities available you can avail of a free financial review with Peter Brown.

This is a “No Obligation” review of your existing investments and pension arrangements to establish if there are any untapped opportunities that could improve your financial position.